Today we announced new data collected from startup founders on the SVB collapse. The goal of the data was to highlight the effect on the banking crisis on the startup ecosystem and how it will change the way they do business going forward.

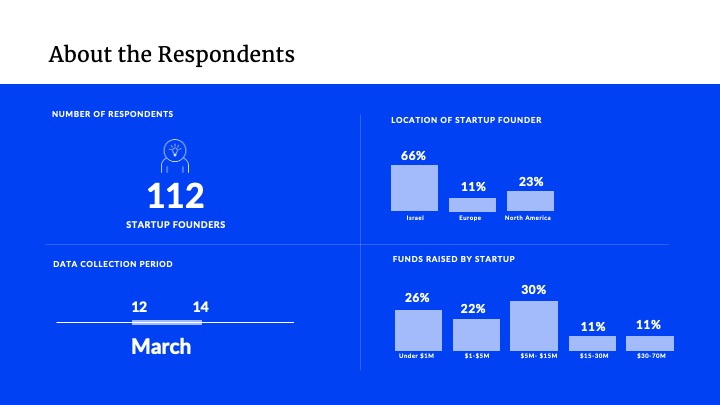

The insights are based on data collected March 12th and 13th from over 100 startup founders across the globe, located in North America, Europe and Israel.

The survey was done by Startup Snapshot in partnership with Intel Ignite, Zell Entrepreneurship Program and Consiglieri

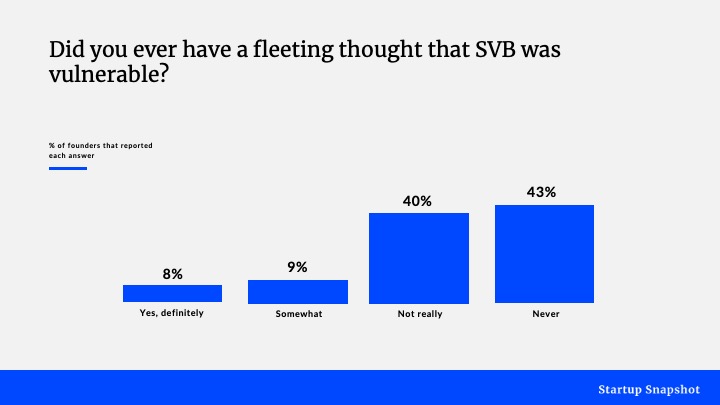

- Some founders had doubts, but the majority did not have a clue that SVB was so vulnerable

Despite having witnessed through the 2008 financial crisis and the collapse of Lehman Brothers, the overwhelming majority of founders did not see this crisis coming at all. When asked if they ever had a fleeting thought that SVB was vulnerable, 43% of founders answered “never” and an additional 40% responded “not really”.

- Trust was broken, both in the regional banks and the bankers that operated them

Despite not having seen the impending crisis from the outside, the majority of founders believe there is a high likelihood that bankers from the inside knew it was coming. The result is a major breach of trust in the banking system as a whole and in the people that operate it.

When asked whether they think SVB bankers knew the risk they were facing, 71% of founders have some doubts that those on the inside were in the know.

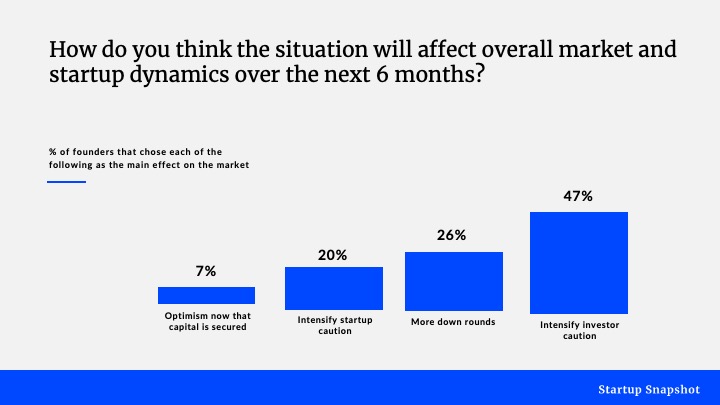

- The dominant effect on the ecosystem will be more investor caution

Despite the quick FDIC response, founders believe that the SVB collapse will have a lasting effect on the market and startup dynamics in the next 6 months. When asked what will be the main effect on the market, the majority predicted more caution and a tightening of financial terms from the investor side.

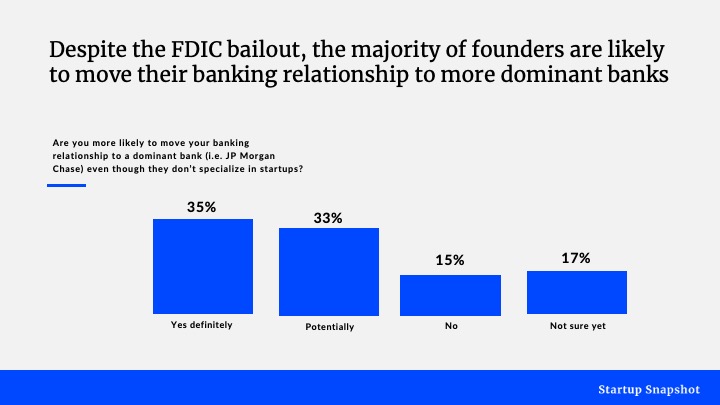

- Dominant banks are the clear winners

With the market instability, dominant banking players are the clear winners coming out of the last few days. Even though these larger banks, such as JP Morgan Chase, do not specialize in startups, the majority of founders will move or consider moving their funds there.

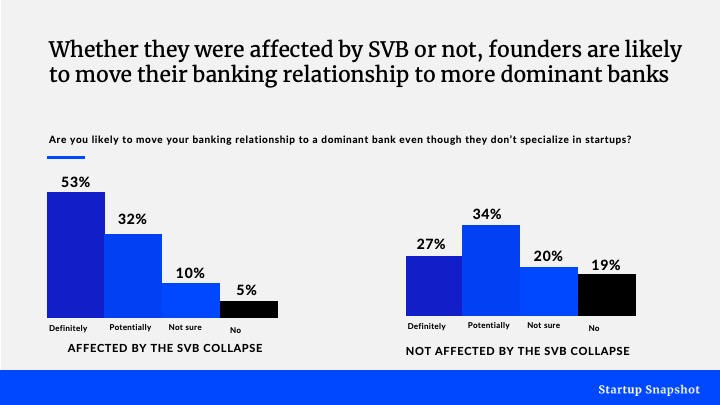

The shift in preference to larger dominant banks can be seen by both startups that have been affected by the SVB collapse and those that have not.

Naturally, those that have been affected by the SVB situation are more likely to move their funds, with 53% reporting that they will definitely move to their banking relationship to a more dominant player and 32% reporting that they will potentially move.

Despite not having been personally affected, the breach in trust across the market is strong, with 61% of founders considering to move their banking relationship to those that they view as more “stable” players. 27% state that they will definitely move their accounts to a more dominant bank and 34% stating that they will potentially move.

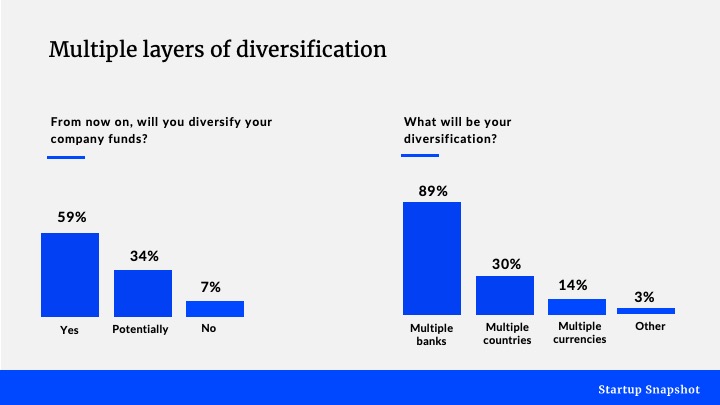

- The main lesson for founders from the collapse- Multiple layers of diversification

The main lesson from the SVB crisis is diversification of funds. 59% of founders reported that from now on they will definitely diversify their company funds and another 34% reported that they will potentially diversify. Diversification will take place across financial institutions, currencies and geographies. 81% reported that they will diversify their funds across multiple banks, 29% across multiple countries and another 14% across currencies.

Some comments from our community about the future of the banking system (honest and unfiltered):

- “I knew they were doing things that were just as bad as 2008. Nothing changed. I always keep more than one account and I will never under any circumstance use only one bank, so nothing changed for me really.”

- “I am much less confident in the US banks”

- “I’ll do more research and not trust banks blindly”

- “The banking system IMO was and will always stay greedy to some extent. This has occurred in the past, but it still keeps on happening today, from a variety of reasons that let the bank be less cautious then it should be. I will keep on taking bankers recommendations with a grain of salt and will keep looking for a second opinion before taking any crucial action”

- “Venture debts are increasing in volatility because they don’t give us enough leeway to generate revenue and pay on time. It looks a lot more like formalized and authorized theft. This situation does not bode well for the future, we need programs adapted to our businesses that solve problems and not create them.”

- “The last few days had me thinking of so many things that are not organized in my head. I need time to think about my different options with intent and mindfulness”

Browse all our reports

Before and after the covid-19 pandemic

Right as the pandemic hit, we set to analyze the early effects on startups. Comparing data collected before and during the outbreak of COVID-19, the…

Adapting to the new remote reality of today

Israeli founders are adapting their workforce, sales, product and fundraising strategy to the new remote reality. Will the remote strengths they are...

Funding terms, talent and global expansion

To shed light on the changing market conditions, we researched the state of early stage tech and identified new strategies for young startups to succeed…

CEOs and investors speak out about the boardroom

Get a sneak peak into the exclusive and private world of today’s early stage startup boardrooms. The data points offer a unique glimpse into how…

Talent in Uncertain Times: The early-stage startup workforce

Get a sneak peek into how the changing economic conditions of 2022 are affecting startup hiring, retention and growth. The goal is to highlight major…

Winds of Change: The shifting startup landscape

To highlight how the changing economic downturn is affecting innovators, we collected data from startup founders and employees in April through August 2022.